Preferred Alternative Payment Methods in Asia Pacific

Tuesday, 29th April 2014

Crossborder-ecommerce.com published an article about preferred alternative payment methods in Asia Pacific.

"Alternative payments enjoy an increasing acceptance. Their transaction revenue accounts for $212 billion of eCommerce payments globally and it is estimated that they will comprise 59% of all online transactions in 2017 (2012: 43%). For payment service providers and merchants it is crucial to develop an adequate understanding of alternative payment methods and their local and industry-specific means in order to meet shoppers’ expectations at the checkout and to achieve fewer higher conversion and, ultimately, higher revenues. While in former posts we already talked about alternative payments in America and Europe, today we will dive into preferred alternative payment methods in Asia Pacific."

"In Australia, eCommerce turnover amounted to $47 billion in 2012, with cards being the preferred payment method (53.4%) and online bank transfers accounting for 22.5%. However, eWallets also serve as a significant method of payment (20%). The most important alternative payment methods in Australia are BPAY, POLi, PayPal and PayMate."

"While Bangladesh’s economy is growing steadily, eCommerce turnover still only makes up 0.2% of the GDP in 2012. Bangladeshis pay mainly by card (56%), although offline methods are still significant (offline bank transfers: 15%, cash on delivery: 23%). EWallets and mobile payments currently only make up 0.2% of all transactions."

"eCommerce turnover in China amounted to $212 billion in 2012, with nearly half of all transactions being made by eWallets (44.3%). The preferred providers are Alipay (30% of all transactions) and Tenpay (13.3%), while PayPal only accounts for less than 1%. Cards account for 15% and cash on delivery make up 10.9%."

"In India, cash on delivery and rechargeable cash cards of retail networks (37.3%) are the preferred payment methods. Mobile payments account for 4% of all transactions while eWallets are still in its infancy (1.5%)."

"In Japan, eCommerce amounted to $155 billion in 2012 and the most popular payment method is by card (59.5%). This is followed by Konbini (16.6%), a local store payments method, and cash on delivery (12.7%). Mobile payments account for only 0.3% and eWallets make up 6.6% of all transactions."

"In comparison to other regions the Asia Pacific eCommerce market is growing rapidly with a B2C eCommerce turnover of $461 billion. Since 61% of online shoppers have greater confidence in a website that offers them a choice of domestic payment methods in a secure shopping environment, it is crucial to understand local preferences. It is important that merchants and payment service providers take the opportunity right now!"

UAE: customers are still reluctant to online shopping - survey

Tuesday, 29th April 2014

According to this, UAE’s online shopping still faces impediments, as in the past 3 months, 43% of the customers have abandoned their online shopping cart and, hence, the purchase has not been made.

"From the 43% figure, 31% have decided against purchasing because they have found the product cheaper elsewhere and 26% distrust the ecommerce sites themselves for adding extra fees at checkout."

"On average, online shoppers in the UAE purchase around 5 items every 3 months and that consumers are complaining that prices through ecommerce sites do not represent significant cost savings."

"35% of those who have shopped online in the past 3 months have used their smartphone to make a purchase, and just 23% prefer to use their tablet for ecommerce transactions. The Index also reveals that whilst 57% of online shoppers have used their credit card to shop online in the last 3 months, cash on delivery is nearly as popular, used by 48%."

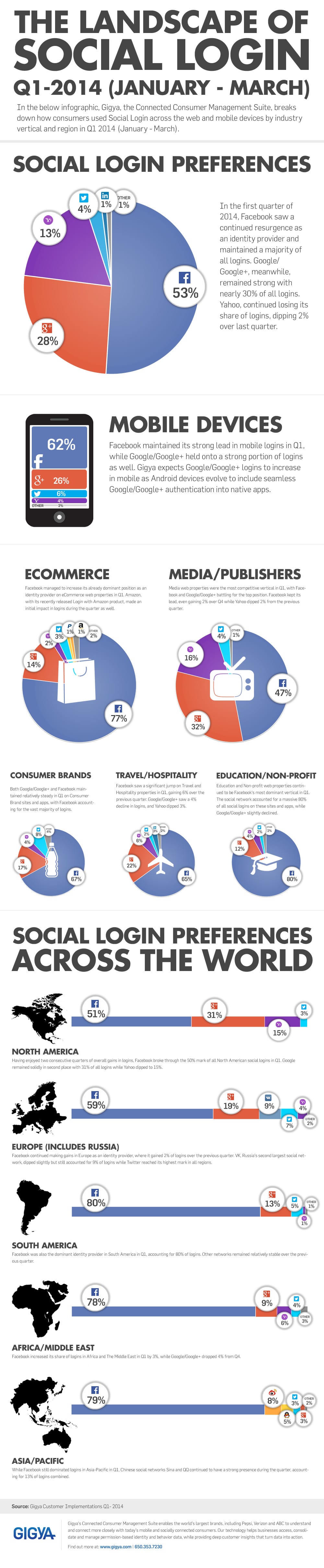

Social Sign-on : the implications for Ecommerce sites - Infographic

Vietnam: ecommerce sales on the wave of consistent increase - report

Monday, 28th April 2014

According to this, Vietnamese online shopping has registered a considerable increase in 2013, with total revenues reaching USD 2.2 billion, or up by 314% by comparison with 2012.

"Online purchase average was USD 120 per capita in 2013."

"The significant growth rate of internet users, which has been triggered by the rapid development of the country’s ecommerce, has determined VECITA to revise its 2015 forecast for the sector from USD 1.3 billion to over USD 4 billion in revenue."

"The current internet-connected population surpasses the 30 million barrier, and about 40%-45% of the total population is forecasted to use the online channel by 2015. VECITA has foretold that every Vietnamese person will spend at least USD 150 on ecommerce purchases on a yearly basis."

"Still, with a population of 93 million projected for 2015, about 65% to 70% of the population with an internet connection will generate from USD 4.08 billion to USD 4.3 billion in online shopping revenue."

"The popular online products were clothes, shoes and cosmetics, making up 62%. The second most popular categories were technology products with 35% followed by household products with 32% and air tickets with 25%."

"Cash was a major payment method in online transactions with 74% of respondents opting for it and 41% transferred via banks. 11% used bank accounts, 9% resorted to mobile and game cards, and only 8% used electronic wallets."

How Does Web Page Speed Affect Conversions? - infographic

Friday, 25th April 2014

"Performance has only recently started to make headway into the conversion rate optimization (CRO) space. These inroads are long overdue, but still, it’s good to see movement. In the spirit of doing my part to hustle thing along, here’s a collection of infographics representing real-world examples of the huge impact of page speed on conversions."

Source Web Performance Today

| Page: 1 / 9 | ||||

| Previous Page | 1 2 3 4 5 6 7 8 9 | Next Page | ||

Archive

- Latest

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)