Bridge Community Farms receives £36,000 donation

Saturday, 17th May 2014

Bridge Community Farms is set to benefit from a £36,000 donation, thanks to The Greif Packaging Charitable Trust.

Bridge Community Farms is a working farm that brings together people from all parts of the local community. Its main purpose is to offer permanent and sustainable jobs to people who are long-term unemployed, growing and selling organic fruit and vegetables to the local community.

Graham Duerden, Managing Director of Greif UK Ltd, based in Ellesmere Port and Burton-upon-Trent, presented a cheque to Francis Ball, Chris Maddock and Hazel Manning, Directors of Bridge Community Farms, on behalf of The Greif Packaging Charitable Trust. The donation will enable the farm to purchase and erect half an acre of polytunnels to grow salads and herbs, create five permanent jobs and provide an exciting study facility for children and young people in the area.

Francis said: “We’d like to say a huge thank you to The Greif Packaging Charitable Trust for this very generous donation. Bridge Community Farms would not exist without the support of local businesses and individuals. This donation will allow us to put up our first polytunnels and kick off this valuable community venture. It really will change the lives of some of the most potentially talented people in Ellesmere Port by allowing us to offer them a helping hand.”

Graham Duerden, MD at Greif Ltd, said: “The Greif Packaging Charitable Trust was set up to help children and young people. Bridge Community Farms provides us with an ideal opportunity to support a local venture that will benefit Ellesmere Port.”

Bridge Community Farms is set to open later in the year. As well as providing sustainable jobs, it will provide a therapeutic environment for people living with mental health conditions such as depression and post-traumatic stress disorder. The farm will also have study facilities for children and young people who want to learn horticulture, food preparation and basic business skills. All profits will be invested back into the farm.

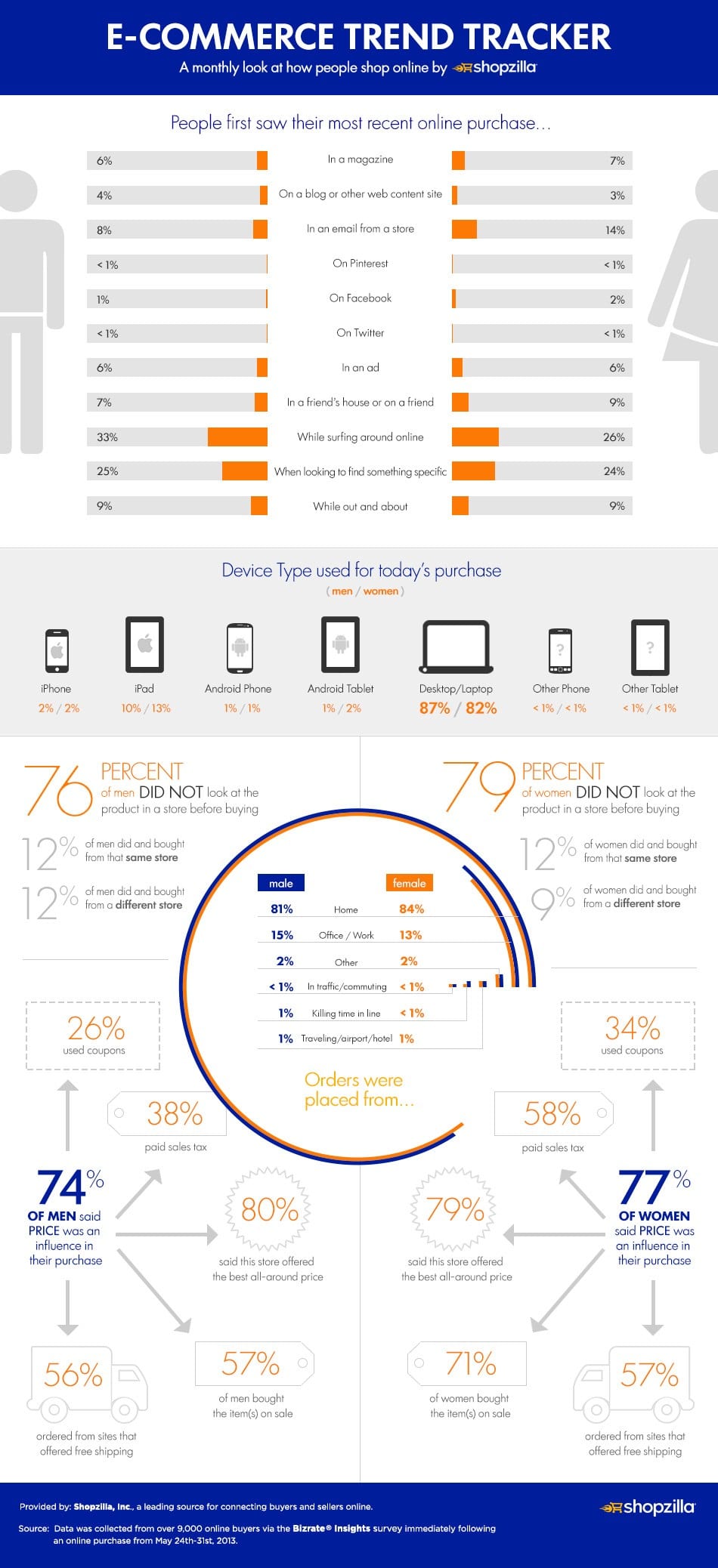

E-commerce Trend Tracker - Infographic

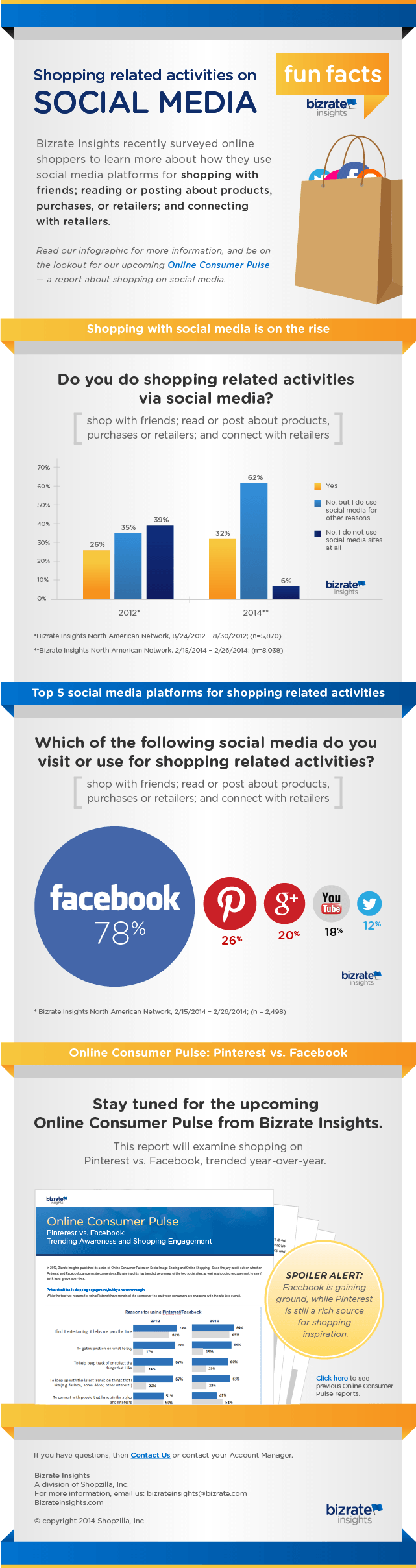

Fun Facts: Social Media & Shopping - Infographic

Scandinavian ecommerce amounts to EUR 4.9 billion in Q1 2014 - report

Thursday, 15th May 2014

According to this, during Q1 2014, 7 in 10 Nordic residents purchased items online for a total value of nearly EUR 4.9 billion (SEK 44.2 billion).

"PostNord’s ecommerce-related B2C parcel volumes increased by 15% in the same time frame."

"75% of Norwegians shop online, while Finland records 66% of its consumers purchasing online in Q1 2014. Mailbox delivery is the most popular delivery alternative in all Nordic countries except Finland, where the preference is to pick up goods purchased online at a partner outlet."

"Out of the total EUR 4.9 billion, the report estimates that around EUR 1.1 billion (SEK 10.1 billion) was generated from ecommerce conducted by consumers via sites they consider foreign."

"33% of Nordic-region ecommerce mail items during the period came from foreign countries, according to consumer estimates. When Nordic residents shop online from foreign sites, they prefer sites from the UK."

More info here.

Marc Barach, Jumio: "The challenges of payment security have always been a balancing act"

Wednesday, 14th May 2014

The Paypers published an interview with Marc Barach, Jumio, on the subject of payment security.

"As mobile consumers, we seem to have a voracious appetite to get the full range of life’s tasks accomplished on our connected devices. Conducting shopping, travel, banking, investing and more are now commonplace, but each one of these activities at some point requires the consumer to fill out long forms on their device. And that’s the problem. Numerous studies show that the more data a consumer must key enter in order to complete a process, the greater is their drop off. That’s something businesses cannot afford. Jumio’s mobile offerings use computer vision technology to scan and validate credentials obviating the need for time-consuming key entry. This allows consumers using our clients’ apps to speed though sign-up and checkout processes, which translates into higher completion rates and satisfaction. This service is offered through three of our products: Netverify, Netswipe and Fastfill."

"The challenges of payment security have always been a balancing act. The industry is often toggling between making the payment process as convenient as possible for the consumer yet safe for the merchant. If that’s out of balance, which is often the case, the merchant is always on the failing end from either losing customers or having high chargeback and fraud costs. The two objectives, ease-of-use and fraud control, have historically been at opposite ends of the continuum – typically when security goes up, the consumer suffers and, if security is lax, the merchant suffers. Jumio has developed a service that breaks open that paradigm – so that both security and consumer experience are improved."

"Companies such as Amazon pioneered the ‘one click’ purchase which is incredibly popular with consumers but, in our view, isn’t the end of the line. We’re working toward the goal of ‘no key entry’ transactions, which represents the next step on the ease-of-use trajectory. This means that real-time authentication activities need to take place behind the scenes while the consumer sails through the transaction. Online merchants spend so much time, money and energy getting people to their websites and apps and often forget that getting them successfully through the sign-up and checkout processes are just as important to meeting their revenue goals."

"Most security processes today use indirect ways such as knowledge-based authentication to authenticate the ID of the transacting customer. These can be effective, but none of them are as good as using the source document (passport, driver license, government ID) or as consumer friendly. Fast, easy and intuitive processes are what create great consumer experiences, which contribute to higher completion rates and revenue. As consumers become more sophisticated, especially on mobile, the tolerance for slow and complex processes is diminishing. At the end of the day, merchants have to figure out how to manage fraud without turning away legitimate consumers. Our whole business is built around making sure we do exactly that."

More info here.

| Page: 5 / 9 | ||||

| Previous Page | 1 2 3 4 5 6 7 8 9 | Next Page | ||

Archive

- Latest

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)