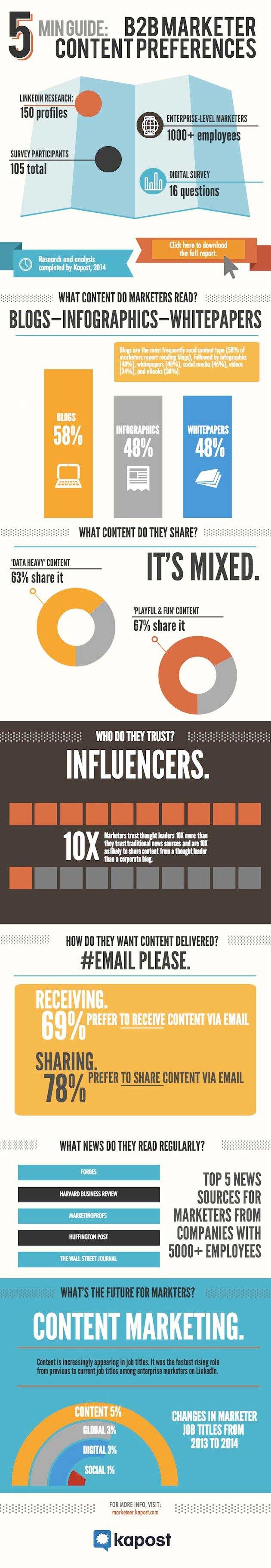

The Content Habits of B2B Enterprise Marketers - Infographic

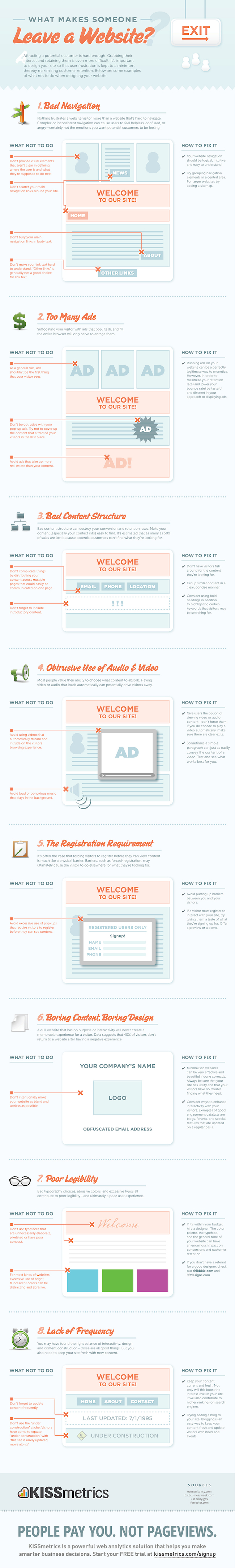

Why People Leave Your Website - Infographic

Ecommerce Europe concerned about a more rigid right to be forgotten

Friday, 7th November 2014

Neelie Kroes, former Digital Agenda Commissioner, has stated that the EU should focus more on making the right to be forgotten clear.

"Kroes has argued its statement with the fact that the European Court of Justice ruling on the “right to be forgotten” is not enough. Ecommerce Europe agrees that clarifications are needed, but stresses that the approach on it should remain flexible, so as not pose too heavy administrative burdens for web shops, and especially SMEs."

"A flexible approach was also agreed upon by the 28 European Justice Ministers in their last meeting. The Ministers declared that search engines are only obliged to remove links with personal information about people under certain conditions. What those conditions are exactly will have to be decided on a case-by-case basis."

"When the right to be forgotten is decided upon a case-by-case basis, judges will be able to take into account the other obligations web shops already have. On the other hand, if policy makers would adopt a rigid approach towards the right to be forgotten, this would mean that any removal request coming from an individual should always be granted. That would happen without taking into account the particularities of the case."

More info here.

How to Increase Facebook Engagement by 275%: Infographic

Immigration issues in different countries

Networking

Wednesday, 5th November 2014

Immigration tends to be an inward focusing issue for many people. The content and emotive issued raised by immigration are based on what immigration is doing to “your” country.

So its a great chance to see how other countries are thinking about immigration through the Guardian newspaper who have published in October 2014.

This networking provides good insight to the cross cultural issues faced by all citizens in the EU.

Ten myths about migration

Writers from the Guardian, Le Monde, El País, Süddeutsche Zeitung and La Stampa address some common claims about migration and assess whether they are true in their country

http://www.theguardian.com/world/2014/oct/21/ten-myths-migration-europe

| Page: 24 / 97 | ||||

| Previous Page | 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 | Next Page | ||

Archive

- Latest

- August, 2025 (4)

- December, 2024 (2)

- November, 2024 (1)

- August, 2024 (1)

- July, 2024 (2)

- June, 2024 (1)

- May, 2024 (3)

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)