Almost half of young people believe mobile security is a priority

Friday, 3rd October 2014

When using their mobile device, 42% of young people say security is more of a priority than convenience (20%).

"58% of respondents have tried to enroll for a new service or account using their mobile device and 75% of those were able to complete the process. 83% say they would be willing to take a few additional steps to verify their identity when opening a new service or account. Fingerprint scanning (60%) is by far the method of choice for security or authentication instead of typing in a password. Following distantly is facial recognition (36%) and about one in four each say they would rather use voice recognition (27%) or signature validation (25%) rather than sign in with a typed password."

"More than half of respondents saying they would deposit checks by snapping a picture and depositing it via a bank’s application (54%). Another 34% have already deposited a check by taking a picture with their mobile smartphone camera, resulting in a potential marketplace with 88% of Millennials having used or being willing to use a smartphone camera for check deposits. Over half (54%) would pay for goods using their mobile device as a mobile wallet instead of credit cards or checks if these services were available to them."

"More than half (52%) think that native (downloaded) applications are safer than mobile websites to use for banking or purchasing transactions. While 38% of smartphone users under 34 think that their mobile device is safer than using a PC, 51% disagree."

More info here.

India: cross-border tax rule for wholesale trading falls to 1%

Wednesday, 1st October 2014

Indian revenue department has reduced the permissible gap between the value of cross-border wholesale trade transactions and their arms-length price computed by tax officials to 1%.

"Previously, the figure was 3%. In case the gap is more than 1%, the wholesale transactions between the Indian unit and the related overseas enterprise will be subject to a rigorous transfer-pricing audit. In the case of all other sectors, the permissible variation between the arms-length price decided by the tax officer and the value declared by the company has been retained at 3%".

"The department had indicated earlier that in sectors where operating profit margin is less, the gap ought to be narrow. In sectors like software development, where operating profitability is higher, unlike wholesale trading, the value of transactions could vary within a range of 3% with respect to the arms-length price attributed by the taxman."

More info here.

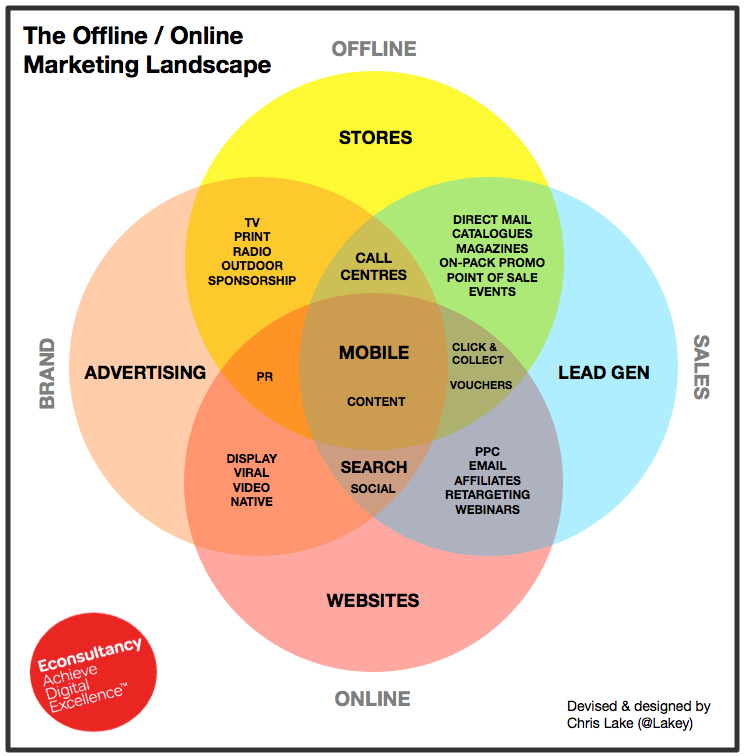

The Offline / Online Marketing Landscape

German ecommerce is expected to reach EUR 42.8 bln in 2014

Wednesday, 1st October 2014

The German ecommerce industry is expected to reach EUR 42.8 billion by end of 2014.

"In 2013, the share of online sales in the total retail industry was 8.4%, but according to the market research agency IFH findings, this share will be 9.4% in 2014."

"There is an expected growth rate of 13% in 2014, while the ecommerce industry grew by 14% in 2013."

More info here.

Spain to embrace Bitcoin as electronic payment system

Wednesday, 24th September 2014

The Spanish government agency that oversees matters of finance and taxation has issued a new Bitcoin-related ruling.

"The ruling, which was issued in response to questions from Spanish Bitcoin exchange platform Coinffeine, states that Bitcoin should be treated as an electronic payment system."

"In April 2014, Abanlex, the law firm representing Coinffeine, reached out to the Ministry of Finance and Public Administration (El Ministerio de Hacienda y Administraciones Públicas) as well as Congress, to obtain a clear legal definition of Bitcoin. With its response, the Ministry found that Bitcoin-based online gambling companies in Spain must now apply for licenses. Further, the ruling, coupled with new statements from Congress, suggests that Bitcoin transactions involving a business may be subject to existing laws that impose a cap on cash transactions of EUR 2,500 or more. However, although the Ministry said it will treat Bitcoin as an electronic payment system for the purpose of gambling law, it is not yet clear if this interpretation is more broadly applicable."

More info here.

| Page: 30 / 97 | ||||

| Previous Page | 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 | Next Page | ||

Archive

- Latest

- August, 2025 (4)

- December, 2024 (2)

- November, 2024 (1)

- August, 2024 (1)

- July, 2024 (2)

- June, 2024 (1)

- May, 2024 (3)

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)