25% of online banking customers in the UK share login details

Tuesday, 20th May 2014

According to this, a quarter of online banking customers in the UK share their personal login details with another person, a recent study shows.

"1 in 4 (24.5%) online banking customers have handed their personal login details over to someone else, while 1 in 5 (19.2%) admitted to giving this information to their partner. Only 1 in 8 (16.2%) revealed to have shared the login information with another family member."

"Online banking login information was not the only type of personal information that customers shared, with 33.2% of current credit card clients admitting to have shared their PIN number with another person, either the spouse (82.5%) or a friend (3.36%)."

"This happens also with payment services such as PayPal and Amazon OneClick, where 24.4% of consumers allow someone else to use their banking details."

EAPS introduces new payment system to boost cross-border trade

Monday, 19th May 2014

The East Africa Payment System (EAPS) has launched a new payment system that will drive trade between Kenya, Uganda and Tanzania.

"By using the new payments system, a trader in Kenya can pay for goods in any of the three region’s currencies without necessarily changing them into a customer’s preferred mode of payment. A customer instructs their commercial bank detailing the currency they intend to transfer across the border and then the bank will conduct the transaction through the EAPS."

"Rwanda and Burundi are also expected to join the system, once they set up the real-time gross settlement (RTGS). The system is part of larger plan by the East African Community partner States to integrate their money and capital markets that has been under development for three years."

More info here.

US registers a 12% ecommerce growth in Q1 2014

Monday, 19th May 2014

According to this, the ecommerce spending for Q1 2014 in the US has been estimated to have grown with 12% year-over-year.

"Study indicates a rise of ecommerce sales up to USD 56.1 billion, making Q1 2014 the 18th consecutive quarter of registered boost and the 14th consecutive quarter of a two-digit increase."

"Mobile ecommerce shares an important part of this turnout, with USD 7.3 billion of spending occurring on smartphones and tablets, a boost of 23% from 2013, accounting for a total of USD 63.4 billion for ecommerce in general in the US. Out of these USD 7.3 billion, 62% of consumer spending occurred via smartphones, and 38% are attributed to tablets. Desktop ecommerce rounded up to 11.7% in matters of consumers’ spending."

China: online shopping to surpass Switzerland's GDP in value in 2016

Monday, 19th May 2014

According to this, Chinese ecommerce platform Alibaba has predicted in its IPO that China’s ecommerce market will grow twofold by 2016.

"China’s online sales were worth USD 295 billion (CNY 1,841 billion) in 2013 and is expected to increase to almost USD 595 billion (CNY 3,790 billion) in 2016, which amounts more than the nominal GDP of Sweden or Switzerland per 2013."

"At present, the amount of money spent in the Chinese retail cyber sphere is larger than the entire economies of Egypt or Finland. China’s internet users reach 618 million, according to government figures, which is just below half of those who regularly shop online. China’s mobile internet user base was 500 million, as of the end of 2013."

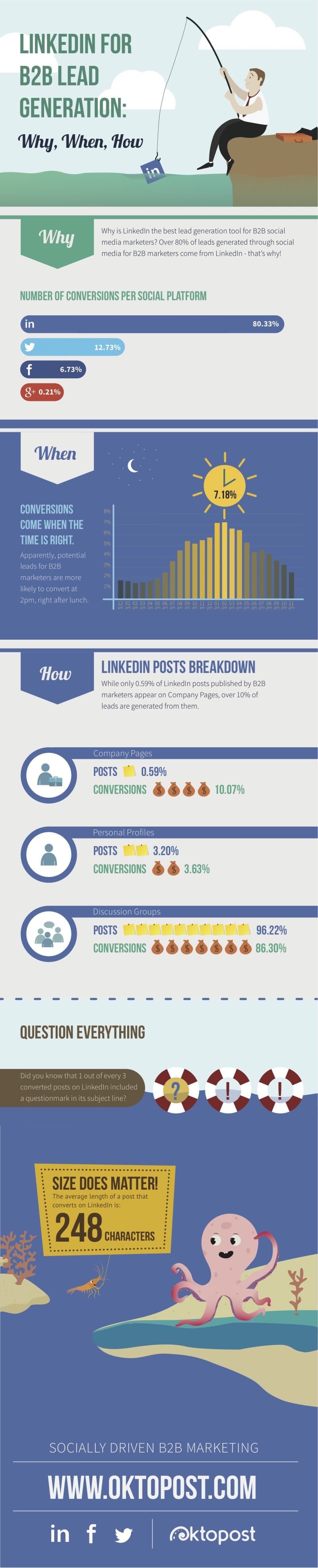

Which LinkedIn features are best for lead generation? - Infographic

| Page: 58 / 97 | ||||

| Previous Page | 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 | Next Page | ||

Archive

- Latest

- August, 2025 (4)

- December, 2024 (2)

- November, 2024 (1)

- August, 2024 (1)

- July, 2024 (2)

- June, 2024 (1)

- May, 2024 (3)

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)