US customers and retailers, most targeted by cyber attacks

Wednesday, 20th August 2014

Though cyber security and data theft are a globally spread phenomenon, public and private entities in the US are the most targeted by cyber-attacks.

"US consumers are not safe and an enormous amount of work is to be done in the US to stop data breaches."

"Point-of-Sale (POS) is one of the most vulnerable locations and a large number of fraud attacks occur at the POS."

"Payments security market in the US was estimated at USD 1,327 million for 2013. Retailers appear to be the most affected by payment frauds, starting to invest in building a secure payments system."

More info here.

Africa: intra-regional trade to boost ecommerce growth

Tuesday, 19th August 2014

The countries of Africa undergo nearly 23% of their cross-border trade.

"The level of intra-African trade is relatively low, as compared to other regions. For example, around 70% of the EU’s trade happens within its borders."

"Improved cross-border payment systems could facilitate intra-regional trade and regions across the continent are beginning to work on greater intra-continent trade. Although intra-regional trade is determined by economic fundamentals of supply and demand, the report notes that the lack of efficient regional payment systems could add significant costs to intra-regional trade."

More info here.

China: notable growth in cross-border online shopping

Monday, 18th August 2014

China's overseas online shopping market has registered a significant growth.

"The value registered by the Chinese online shoppers buying from abroad via domestic electronic payment methods jumped from USD 1.95 billion (CNY 12 billion) to more than USD 11.36 billion (CNY 70 billion) between 2010 and 2013."

"Alipay, China's largest third-party payment platform, recorded a 117% growth in its cross-border e-payment services from 2011 to 2012, whereas the average pointed to a 64.7% growth for other ecommerce companies."

More info here.

UK: High rates for online shopping, banking with stigma still attached to cards - report

Monday, 18th August 2014

74% of UK adults have bought goods or services online in 2014 (compared to 53% in 2008) and 53% adults bank online.

"There is a risk coming from a section of society that is excluded simply because they don’t have credit or debit cards."

"81% of shoppers who have been refused credit feel there is a negative stigma attached to it. A shocking 27% of online shoppers who have been refused credit reported feeling like outcasts from society."

"33% of online shoppers being unaware that you can buy goods online without a bank account or credit card, while 53% complained about a lack of payment alternatives from online retailers."

More info here.

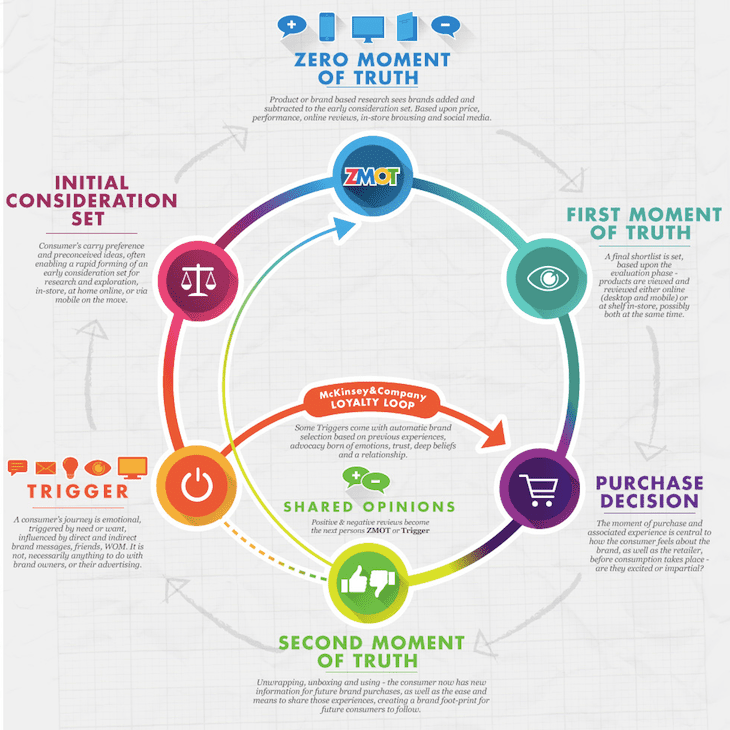

What influences purchase of your product or service? [Infographic]

| Page: 3 / 6 | ||||

| Previous Page | 1 2 3 4 5 6 | Next Page | ||

Archive

- Latest

- February, 2024 (1)

- November, 2023 (2)

- June, 2023 (1)

- January, 2023 (1)

- November, 2022 (1)

- August, 2022 (1)

- July, 2022 (1)

- May, 2022 (1)

- April, 2022 (1)

- March, 2022 (3)

- April, 2016 (1)

- February, 2016 (1)

- November, 2015 (2)

- September, 2015 (4)

- August, 2015 (4)

- July, 2015 (6)

- June, 2015 (8)

- May, 2015 (4)

- April, 2015 (1)

- March, 2015 (3)

- February, 2015 (1)

- December, 2014 (35)

- November, 2014 (33)

- October, 2014 (28)

- September, 2014 (20)

- August, 2014 (30)

- July, 2014 (46)

- June, 2014 (40)

- May, 2014 (50)

- April, 2014 (41)

- March, 2014 (23)

- February, 2014 (54)

- January, 2014 (37)

- May, 2013 (19)

- April, 2013 (8)